Atinum Investment has launched a $597.2 million(KRW 800 billion) venture fund called Atinum Growth Investment Fund 2023.

Atinum Investment held a general meeting on the 18th to finalize the establishment of Atinum Growth Investment Fund 2023. With this, Atinum Investment has established the largest fund in the history of the domestic venture capital industry, following the $410.7 million (KRW 55 billion) Atinum Growth Investment Fund 2020, which was established in 2020.

Through this fund, Atinum Investment will invest 60% of the fund’s capital in startups that are at least three years old and have a pre-investment enterprise value of $37.3 million (KRW 50 billion) or more. The focus will be on growth stage companies in innovative growth sectors, with particular emphasis on Service/Platform, Deep Tech, Bio/Healthcare and Content/IP, where Atinum Investment has developed expertise through its long history of investing. Atinum will actively seek out early-stage companies that have the technology and business model to become leaders in their respective markets, as well as companies that are in the cluster stage, and will make large-scale investments in so-called “game changer” companies that are redefining the rules and trends of existing industries.

Continuing Atinum’s “One Fund” investment strategy of concentrating all of its investment capabilities in a single fund, the creation of a larger fund will allow Atinum to make successive investments at each stage of a startup’s growth. Through active follow-on investments, the fund will serve as a priming pump to support growth so that companies can achieve meaningful long-term results. We will also strengthen our role as a partner to support the stable growth of our portfolio companies. In addition, the company plans to maximize the growth potential of its portfolio companies in various aspects such as investment strategy and business development, human resources, legal and public relations, with the Growth Partner Headquarters, an organization that supports the growth of portfolio companies, at the center.

Atinum Investment is also expanding into global startup sourcing and investment. After establishing an office in Singapore in 2021, Atinum Investment plans to allocate 10-20% of its total commitments to overseas investments. Southeast Asia and the U.S. will be its main focus, and it will actively invest in companies that will become global leaders in the future.

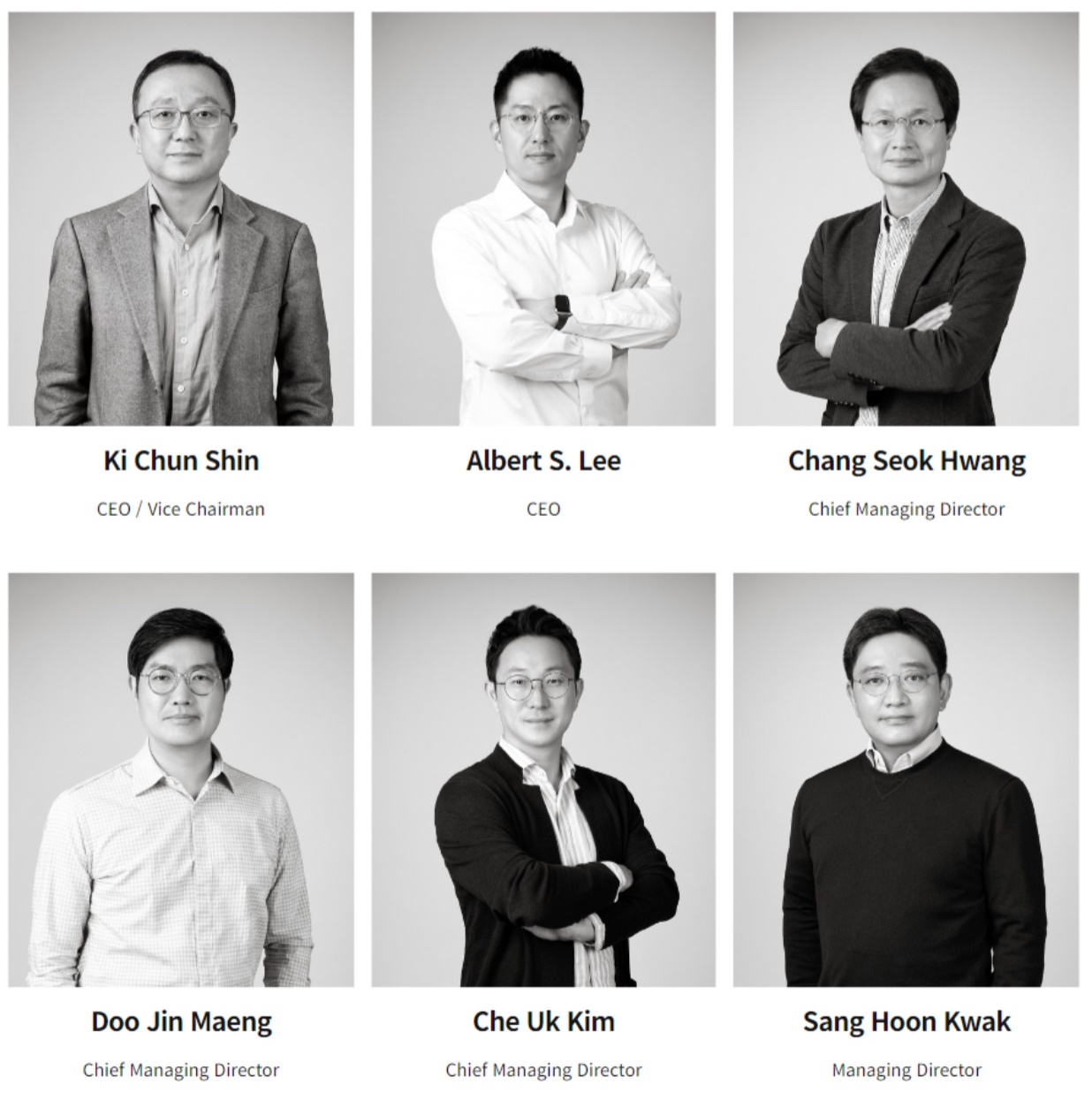

Che Uk Kim, Chief Managing Director of Atinum Investment, who serves as the lead fund manager, said, “We have been able to complete the formation of this mega venture fund despite the challenging market conditions because we have earned the trust of our investors through our large-scale one-fund strategy. With hundreds of millions of dollars in real assets, we will lead large-scale investments in companies that change the rules and trends of industries and move forward as an anchor investor to lay the foundation for the next generation of growth in the Korean economy and promote the creation of global unicorn companies.”

Atinum Investment is a KOSDAQ-listed startup investment firm founded in 1988 that has established 26 associations and completed 22 liquidations to date. Its portfolio companies include Dunamu, Wanted Lab, EchoMarketing, RIDI, OPENEDGES Technology, BC&C, LegoChemBiosciences, Kobiolabs and Precision Biosensor.

Leave a Comment