The first pick in the Nippon Professional Baseball (NPB) draft allows all teams, regardless of region or affiliation, to nominate a specific player at the same time, so when a great player comes along, it’s not uncommon for all the teams to cast lots to get the first pick and priority negotiating rights. However, there is a big risk here. Even if you win the lottery and get the right to negotiate, the player can still refuse to sign. In fact, many players are willing to wait a year to join the club of their choice. It is a system where the ultimate winner is the one who wins both the odds and the player’s heart.

Eleven years ago, Japan’s greatest talent was about to graduate from high school. He was a “unicorn”, a pitcher who threw a 160km/h fastball and a hitter who was being touted as a superstar. But 11 of the 12 professional teams in Japan passed on him. The player’s heart was set on the American Major League Baseball (MLB), and there was also strong interest from local clubs. When asked about his future, the player said: “I will challenge the major leagues even if I am drafted by a Japanese professional team. However, only one club, whose motto is “good players should be drafted”, was able to make the first selection and win the right to negotiate. The team had failed with the same approach the previous year, so few expected them to get the results they wanted. But after a lot of hard work, the club managed to change the player’s mind. The player’s name is Shohei Otani and the team is Hokkaido Nippon-Ham Fighters.

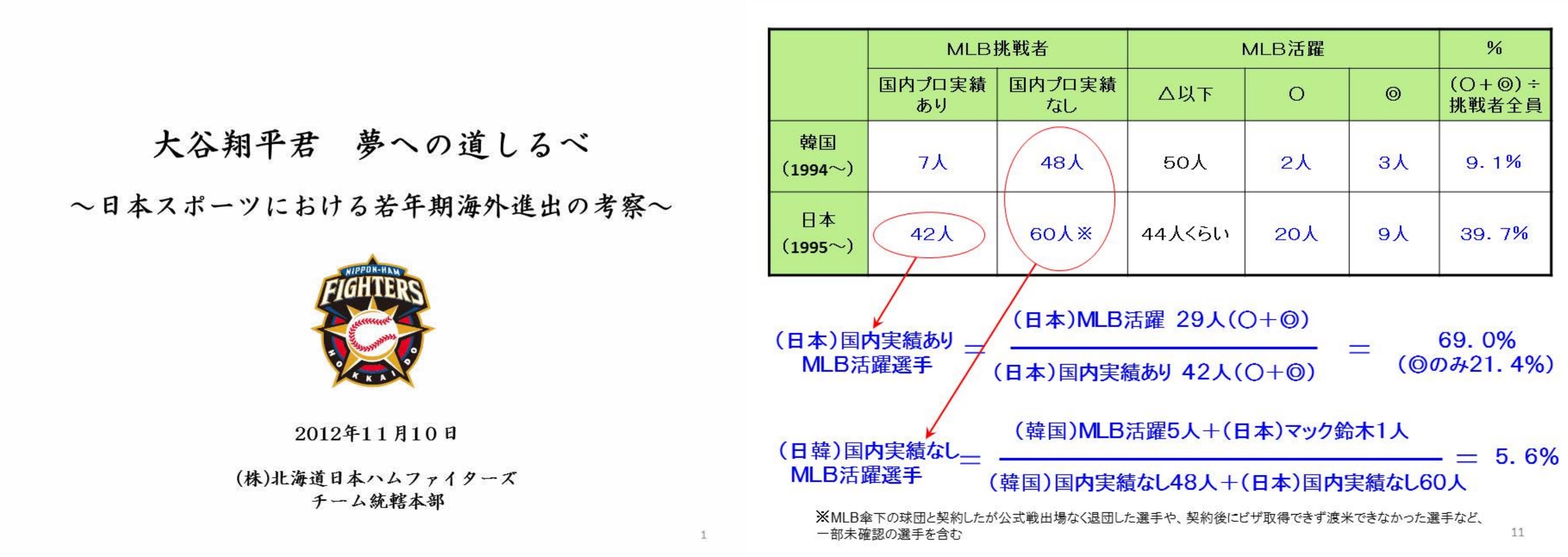

Nippon-Ham Fighters famously created and delivered a 30-page PPT presentation to persuade Otani to sign with them. Otani was reluctant to meet with club officials, but a plea from the septuagenarian manager and a senior baseball player led to a meeting. The club wrote a report from the player’s point of view. The document, entitled ‘A Milestone on the Way to Otani’s Dream’, states that statistically, players with experience in the Japanese and Korean professional leagues are more likely to succeed in the major leagues. It also mentions the number 11 worn by Otani’s role model, Darvish Yu, and the “two-way” development plan for the skills of pitchers and hitters. The idea is that there is an intersection between what the player really wants (to succeed in the major leagues) and what the club wants (to win in their home league and be a box office draw). Otani later said that there was something in the report that he hadn’t considered.

Otani changed his mind and joined Nippon Ham Fighters in 2013, where he began his professional career as a pitcher and hitter in his first year, leading the team to the Japan Series title in 2016 and winning the Pacific League MVP. He then joined Major League Baseball’s Los Angeles Angels in 2018 for a hefty transfer fee from Nippon Ham via the posting system. His rise has been nothing short of sensational. After winning American League Rookie of the Year in his first year, he was unanimously voted American League MVP in 2021, and in 2022 he broke records with 15 wins, 30 home runs, and both regulation innings and regulation at-bats. In 2023, he won 10 games as a pitcher and hit 44 home runs as a hitter, becoming the first pitcher to win the home run title. He became the first player in MLB history to win two unanimous MVP awards. He also broke the free agent market record with a 10-year, $700 million (approx. KRW 924 billion) contract – a truly unprecedented feat.

Recently, there was a domestic event that was reminiscent of the case of Otani and the Nippon Ham Fighters.

The d.camp All Star League 2023 event, held on the 29th of this month, featured a ‘VC Battle’ event, where investment firms (VCs) took to the stage to be judged by an audience of startup representatives. It is a ‘reverse battle’ format, reversing the usual format of startups presenting and VCs judging.

Something so obvious has been forgotten. While investors can choose startups, startups can also choose investors. Of course, it’s possible for a startup to “pick” an investor and get funded. But very few do. It’s more likely that the startup will court the investor and the investor will court the startup. You could compare the relationship between a startup and an investor to a romantic relationship or marriage, where the decision to marry is based on a one-sided crush. Therefore, there is a formula of “what to do and what not to do” to get an investment from an investor, which is of course a strategic approach to doing business.

The presenters are all well-known figures who are often invited to judge or mentor at demo days. They explained why they should be invested in, including their founding background, investment philosophy, human resources, portfolio composition and examples of successful investments. It was a competitive PT and the audience could choose to be the vote controller.

It’s not that there haven’t been pitching events with the same concept in the past. But this one was different in that it didn’t just end with an event, but the winning investor would get priority consideration for a $1.2 million (KRW 1.5 billion) D-Camp investment and the opportunity to co-host D-Day in January.

Eight companies participated in the first round of heats and the second round of finals, including MashUp Angels, ETRI Holdings, Series Ventures, Nautilus Investment, The Ventures, Sopoong Ventures, SparkLabs and Capstone Partners.

It is commonly said that investor relations, the act of engaging with investors, is one of the biggest hurdles for startups seeking investment. The investors on stage had themes in their pitches to impress the startups. Some focused on portfolios, success stories and numbers, as if they were pitching to a limited partner (LP), while others focused on stories, such as their relationship with the founder. They showcased the firm’s strengths, but also humanised them as partners. For the event side of things, some pitches rapped and had their phone numbers on stage.

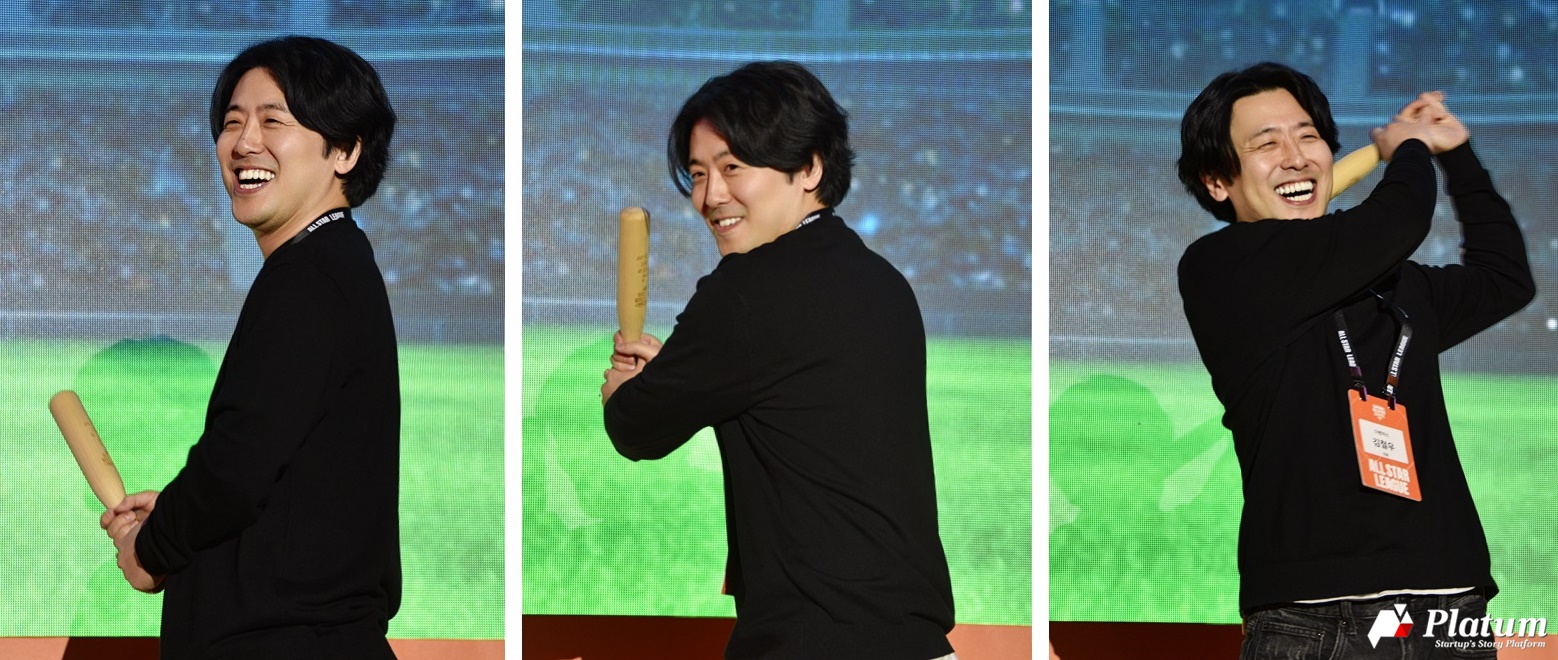

The finalists were Eunkang Song, CEO of Capstone Partners and Chulwu Kim, CEO of The Ventures. The two were asked to answer eight keyword questions from the audience, with Chulwu Kim, CEO of The Ventures, emerging as the winner after a live audience vote. Although it was a competitive PT, the event was organised like a festival and ended with a great response from the audience.

Chulwu Kim, CEO of The Ventures, said, “It was a great opportunity to learn more about the mindset of startups doing PT.” “The theme of the presentation was to think and execute from a founder’s perspective. Above all, it is very meaningful that we won the first place based on the votes of the founders.”

It’s pointless to rank the houses that presented on the day, as they all have their own strengths and characteristics in terms of fund size, investment stage and personnel. However, The Ventures’ win gives us a sense of the type of investor startups are looking for these days. As far as we can abstract, we can think about the type that is considered the most complete, the ideal. Let’s look at The Ventures’ story from that perspective.

Founded by co-founders Changseong Ho and Jiwon Moon, The Ventures stands for ‘founders helping founders’. Since its launch as an accelerator in 2014, it has grown steadily each year, focusing on early-stage investments in Korea and Southeast Asia. Chulwu Kim, co-founder of Sellit, which successfully exited after receiving its first investment from The Ventures, joined the firm as a new partner in 2020 and took over as head of The Ventures in Korea in 2021, committed to founder-centric investing and fostering a community of founders.

The team is made up of founders who have experienced exits, so they understand the pain points of startups and can provide coaching based on their experience even after the investment. The company’s policy is to respond to investment reviews within a week, which has been well received by founders who are tired of hearing “wait and see” from investors.

Chulwu Kim, CEO, said: “We are all founders, so our investment process is designed from a startup perspective. When we get a call, we respond 100%. The review time is also not dictated by the investor. If we go through a formal review process, we respond within a week. We pride ourselves on being the fastest in Korea.

Investor follow-up is important and necessary. Startups don’t just want a financial investment. But time-poor startups often feel overwhelmed by the demands of investors. The Ventures’ approach is not to overwhelm founders, but to actively engage with them when they ask for our help.

“Once we make an investment, it’s all about how we can help the startup,” says Kim. We don’t bother our portfolio companies. Instead, when they ask for help, we pull out all the stops. Having started a business myself, I know how lonely and difficult the journey can be. It’s great to have a trusted friend who has been there before. We can be that friend, and we have a community of founders from the 180 startups we’ve invested in to help us along the way.

The Ventures has also taken some unique steps to differentiate itself from other investment firms. The Ventures is the first Korean venture capital firm to launch a community app, TheVentures, for information sharing and communication among founders. The Ventures has also tried to increase contact with early-stage startups by launching “The Ventures Online Sprint”, which allows early or potential startup teams to quickly validate the market online, and by introducing “Open Referral”, a startup referral programme.

They’re also serious about going global. Principals Changseong Ho and Jiwon Moon are based in Singapore, and partner Daehyun Kim is based in Vietnam, where he facilitates local investment and domestic and international connections. The Ventures has invested in start-ups in 12 countries, including Korea.

“The Ventures is a young team of people who have been through the exits and can talk like friends. We have a community of entrepreneurs, a global network and a track record of investing. Kim concluded his presentation by saying, “The Ventures is a young team of people who have been through the exits and can talk like friends.

There is not a lot of information available to the public about venture capital firms. There are a few blind services that rate VCs, but they don’t tell the whole story. While some firms try to be proactive in their branding, there are also firms that are reluctant to reveal themselves. The VC Battle makes sense in terms of moving the needle on the information imbalance. Hopefully we’ll see more of it, and founders and VCs will be able to find partners who are a better fit.

![[스타트업 탐방] 오후 5시, 자리는 비었지만 일은 계속되는 회사… 하이퍼커넥트 DSCF6818](https://platum.kr/wp-content/uploads/2025/11/DSCF6818-150x150.jpg)

![[BLT칼럼] 엔젤투자의 3가지 즐거움 1114b3aee2b12](https://platum.kr/wp-content/uploads/2025/11/1114b3aee2b12-150x150.png)

댓글 남기기