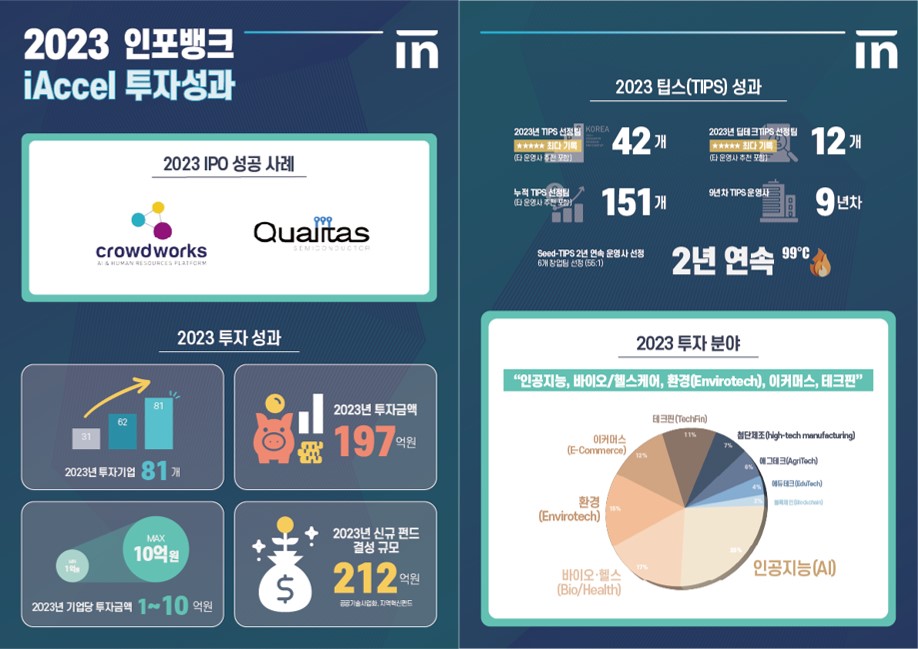

Infobank’s investment arm, iAccel(인포뱅크 아이엑셀), has announced its annual investment results and performance for 2023.

Over the past year, iAccel has invested in the Artificial Intelligence (AI), Bio/Health, Envirotech, e-Commerce and TechFin sectors, focusing on startup teams with high potential for future growth based on technology.

In 2023, iAccel invested in 81 new companies with a total investment of $14.7 (KRW 19.7 billion), an average investment of $180,000 (KRW 240 million), new fund formation of $9.04 million (KRW 21.2 billion), and 151 teams cumulatively selected for TIPS. In addition, iAccel established a Public Technology Commercialisation Fund to discover companies with technology transfer from public research institutions such as universities and government-funded/government-contributed research institutes, and a Regional Innovation Fund to discover companies located in non-metropolitan areas. As a result, iAccel was able to position itself as an early-stage investment institution.

In addition, 42 companies were selected for the TIPS Matching Programme, a private initiative by investment firms to support technology start-ups, and 12 companies were selected for the newly established Deep Tech TIPS last year.

In particular, with the IPOs of two companies, Crowdworks and Qualitas Semiconductor, iAccel has provided a powerful example of the full process of discovery, investment, nurturing and recovery from initial investment to IPO.

In addition, iAccel was selected as the first pilot operator of the Private Initiative for Preliminary Startup Support Programme (hereinafter referred to as Seed TIPS) in 2022, and has been selected as the Seed TIPS operator for two consecutive years, demonstrating its excellent operational capabilities. iAccel also provides customised solutions by diagnosing the weaknesses of startup teams through the 99℃ Batch programme.

In 2024, iAccel will continue to focus on increasing the likelihood of success for its portfolio companies through its proprietary segmented and systematic acceleration programme. In particular, iAccel plans to expand its investments in Deep Tech areas such as Big Data/AI, Bio/Health, Eco/Energy, Robotics and Quantum Technology, as well as Agritech and Envirotech.

“Based on the successful IPO experiences of Socar in 2022 and Crowdworks and Qualitas Semiconductor in 2023,” said Hong Jongcheol, representative of Infobank iAccel, “we plan to focus more on post-IPO management in 2024, including strategic commercialisation guidance and systematic growth support to help our portfolio companies grow rapidly. From overall business diagnosis to follow-up support, including business strategy, PR/marketing, financing and overseas expansion, we will provide generous support through Infobank’s investment network. “He expressed his ambition.

Leave a Comment