Platum published a research report analyzing 2016 annual Korean startups’ investment trends. The report summarizes the monthly investment trends, investments by scale, investments by business type/period, investment firms, and annual M&A status in 2016 based on publicly released 347 cases of startup investments and 22 cases of M&A information.

Basic Data Used in the 2016 report includes below:

- Number of Investment and M&A in 2016 : 369 (347 Investments and 22 M&As)

- Number of Startups that raised funding in 2016 : 210 (232 companies with full disclosure, 5 partial disclosure, and 76 nondisclosure of the amount)

- Number of Businesses Involved in Investment in 2016 : 249 (with company names released)

- Definition of a Startup: “A company with a business model that is expected to grow rapidly based on new ideas or technologies, usually a bei coincierge company not listed on the stock market or merged into a large company” (partially adopting the definition from Startup-Alliance Korea)

- For companies that raised funding more than twice a year, figures have been calculated based on the accumulative investment amount (including partially disclosed amount).

- Investment scale graph is targeting the 237 companies with fully disclosed and/or partially disclosed amount only.

- Assessment of business period has been calculated with Dec 2016 as the end date.

- Most joint investors do not open their investment amounts; thus, only the numbers of investment participation and scale of investment have been applied.

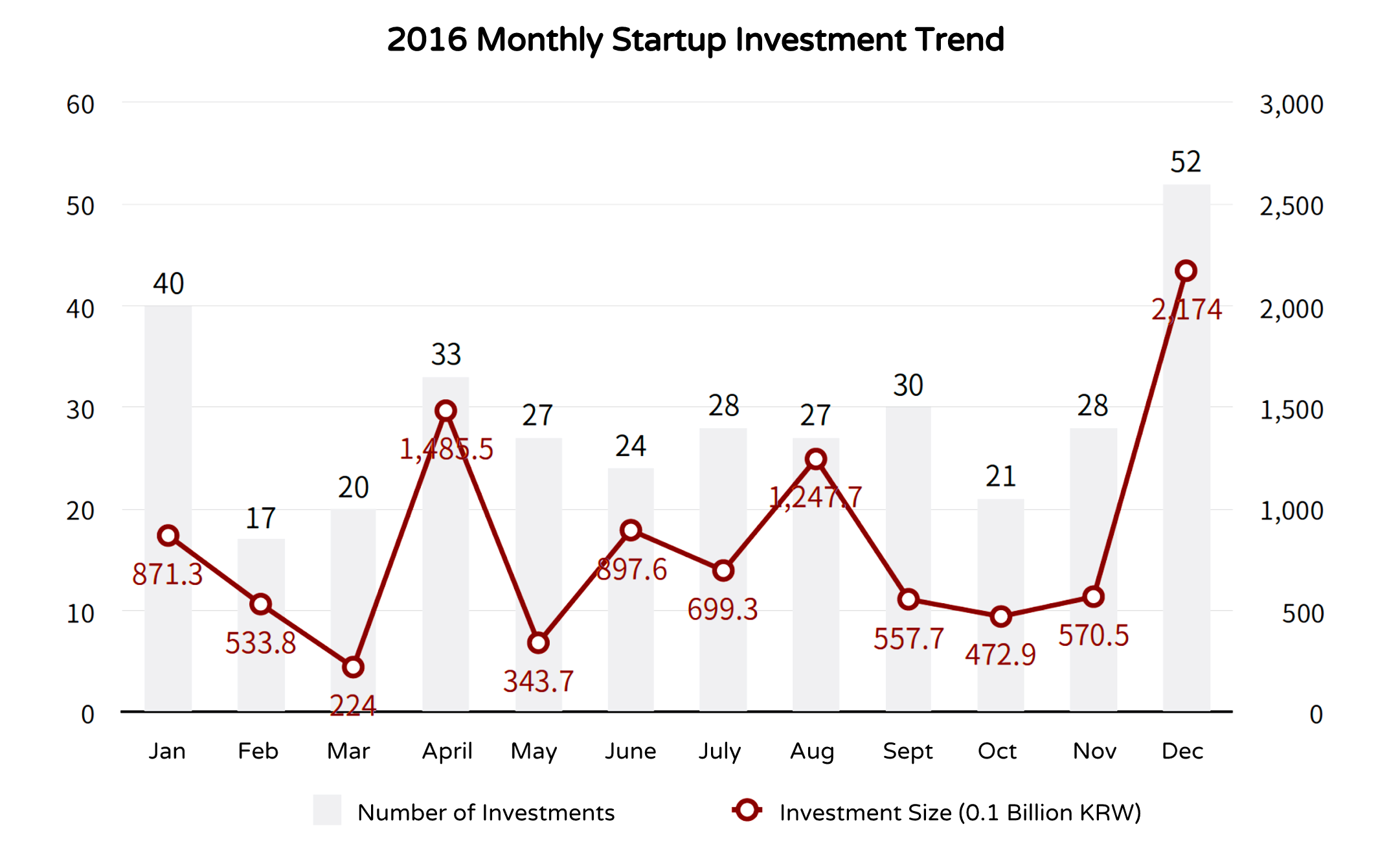

Korean startup market had significantly more dynamic year with 49% of YoY growth (233 in 2015, 347 in 2016) in number of investments and 23% increase (811.96 Billion KRW in 2015, 1007.8 Billion KRW in 2016) in investment size. There was an average of 29 investments per month, with December being the highest (217.4 Billion KRW in total investments).

Memebox raised the largest round of funding with 73 Billion KRW in August and a follow-up funding of 70 Billion KRW in December. Socar, Korean car-sharing service, raised the largest funding in 2015 with 65 Billion KRW. Other notable investments of the year include Woowa Bros, builder of Korea’s prominent food delivery mobile application that raised series E round of 57 Billion KRW in April and Lezhin Entertainment, Korean webcomics service, raising 50 Billion KRW in June.

In terms of investment sizes, 0-0.99 Billion KRW (73 cases) and 1-2.9 Billion KRW (83 cases) were the prominent ranges, comprising 41% of the total investments. 10-19.9 Billion KRW range was the least common investment size with only 8 cases. Despite having only 9 cases of investment, 20-99.9 Billion range had the largest total funding size with 416.3 Billion KRW. Startup investment trends by the business period, 1-2 years group had the highest number of investments (90 cases), constituting 29% of total number of investments. However, the group’s investment amount was only 13% (129.52 Billion KRW) of the total investment amount.

Early stage investments are playing significant role in Korean startup ecosystem as investment on startups with 0-3 years of business accounted for 66% of the total number of investments in the market. For startups with 0-5 years of business, the average investment size increased as the duration of business prolonged. For example, startups with 4-5 years of business had the biggest investment amount of 327.75 Billion KRW but also had the highest ratio of investment amount to number of investments with an average of 10.93 Billion KRW per startup (30 startups).

ICT (Information and Communication Technology) was the top industry sector with the highest number of investments, with 173 startups in 2016. It also received the biggest amount of investment totaling 451.44 Billion KRW. 2 Bio/Healthcare and Supply-Chain/Service sectors followed the list with 10% (32 startups) and 9% (29 startups), respectively.

Investment amount wise, Supply-Chain/Service and Cultural-Contents sectors topped the market with 22% (222.44 Billion KRW) and 11% (114.26 Billion KRW) each, thanks to MemeBox which raised 143 Billion KRW.

Life services field, which includes Woowa Bros and Yello O2O, received the largest amount of investments in the ICT sector again following 2015, comprising 13% of the total investments in ICT field. Fintech startups continue to be a popular investment option (8%) since 2015. As Artificial Intelligence and VR/AR technologies receive more attention in Korean market, investments toward technology-based startups (4%) have grown significantly.

A total of 249 investment firms participated in Korean startup market in 2016, 20% from overseas. Venture capital firms played the biggest role with investments in 83 startups (41.5%), followed by corporations and foreign firms. It is interesting to note that angel investors in Korea have much smaller footage in startup ecosystem compared to the foreign counterparts such as the Silicon Valley.

A total of 249 investment firms participated in Korean startup market in 2016, 20% from overseas. Venture capital firms played the biggest role with investments in 83 startups (41.5%), followed by corporations and foreign firms. It is interesting to note that angel investors in Korea have much smaller footage in startup ecosystem compared to the foreign counterparts such as the Silicon Valley.

In terms of investment amount, Hillhouse Capital Group (57 B KRW to Woowa Bros), IMM PE (50 B KRW to Lezhin Entertainment), SBI Holdings (363 B KRW to YelloMobile), Q Capital Partners (25 B KRW to YelloO2O), and JKL Partners (20 B KRW to WithInnovation) topped the list. Most active investors were K-Cube Ventures (24 startups),Stonebridge Capital (20), KAIST Venture Investments (16), D.Camp (15), and Strong Ventures (13). There were 22 M&A deals in 2016. As YelloMobile’s aggressive acquisitions (15 startups in 2015) decreased in number, we saw much less M&A deals in 2016 (40 to 22). Acquisitions range in fields from on-demand O2O services to education and health services. In 2016, there were 4 IPOs to KOSDAQ: Incross, Me2On, 500V, and OceanBridge.

There were 22 M&A deals in 2016. As YelloMobile’s aggressive acquisitions (15 startups in 2015) decreased in number, we saw much less M&A deals in 2016 (40 to 22). Acquisitions range in fields from on-demand O2O services to education and health services. In 2016, there were 4 IPOs to KOSDAQ: Incross, Me2On, 500V, and OceanBridge.

* 0.1 Billion KRW = $87,435.52 USD (3/15, 2017)

Source: techforkorea

댓글 남기기