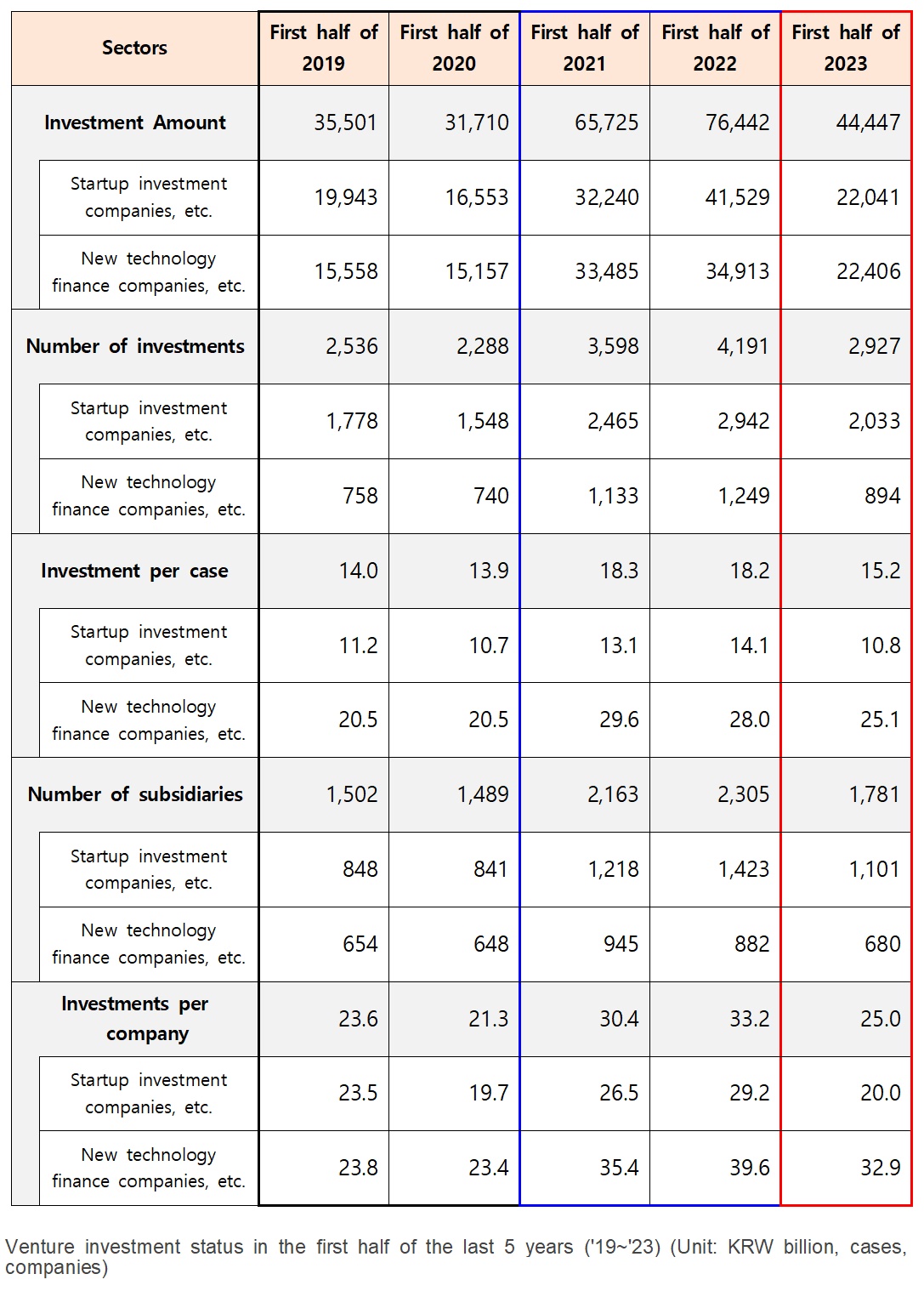

According to the domestic venture investment and fund formation trends in the first half of 2023 released by the Ministry of Small and Medium Enterprises and Startups and the Financial Services Commission, venture investment in the first half of 2023 was significantly higher than the level in the first half of 2019-2020, although lower than the level in the first half of 2021-2022, which saw an unusual surge in performance due to liquidity expansion. This trend applies not only to the performance of startup investment companies, but also to the performance of new technology finance companies.

An analysis of venture investment trends over the past 15 years, from 2008 to 2022, shows a return to the long-term trend in the first half of 2023. In 2021 and 2022, the unusual surge in investment was concentrated in some relevant sectors, such as non-face-to-face and bio, at higher than normal levels, but in 2023, the sectoral concentration eased. As a result, we estimate that total investment in 2023 will be slightly above the long-term trend.

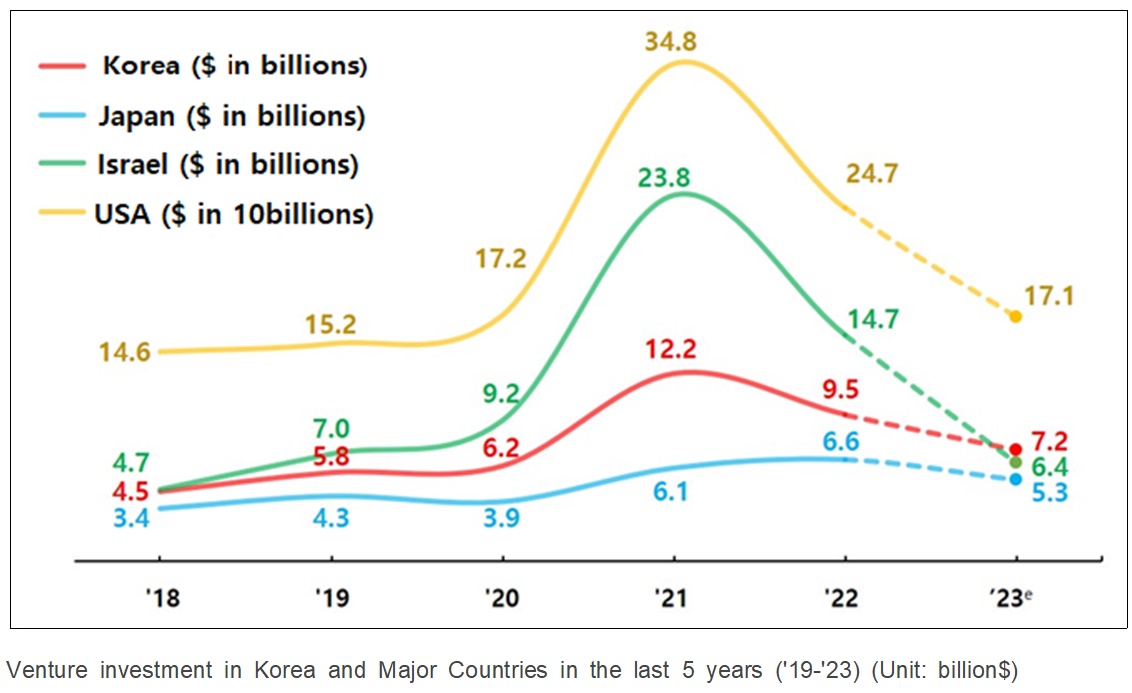

The study also analyzed the last five years (’18-’22) of venture investment in major developed economies, including the U.S., Japan and Israel, and found a common spike in investment in 2021 and 2022 after COVID-19. We also found that the performance of venture investment in each country was synchronized around this time.

In the first half of 2023, venture investment totaled 4.4 trillion won (approximately $3.4 billion), an increase of 25 percent from the same period in 2019 and 40 percent from the same period in 2020. Although the year-on-year decrease was 42 percent, it is important to consider that all major countries around the world experienced an unusual surge in venture investment due to the expansion of liquidity in response to COVID-19, as well as skewed investment in some industries.

With the full implementation of the “Innovative Venture and Startup Financing and Competitiveness Enhancement Plan,” including the Special Credit and Technology Specialty Guarantee Funds (currently being supported as of August 23), the increase in the investment limit for bank venture funds (July 23), and the establishment of a tax credit for corporate investment in private venture capital funds (July 23), the likelihood of a soft landing in the venture investment market is expected to increase further.

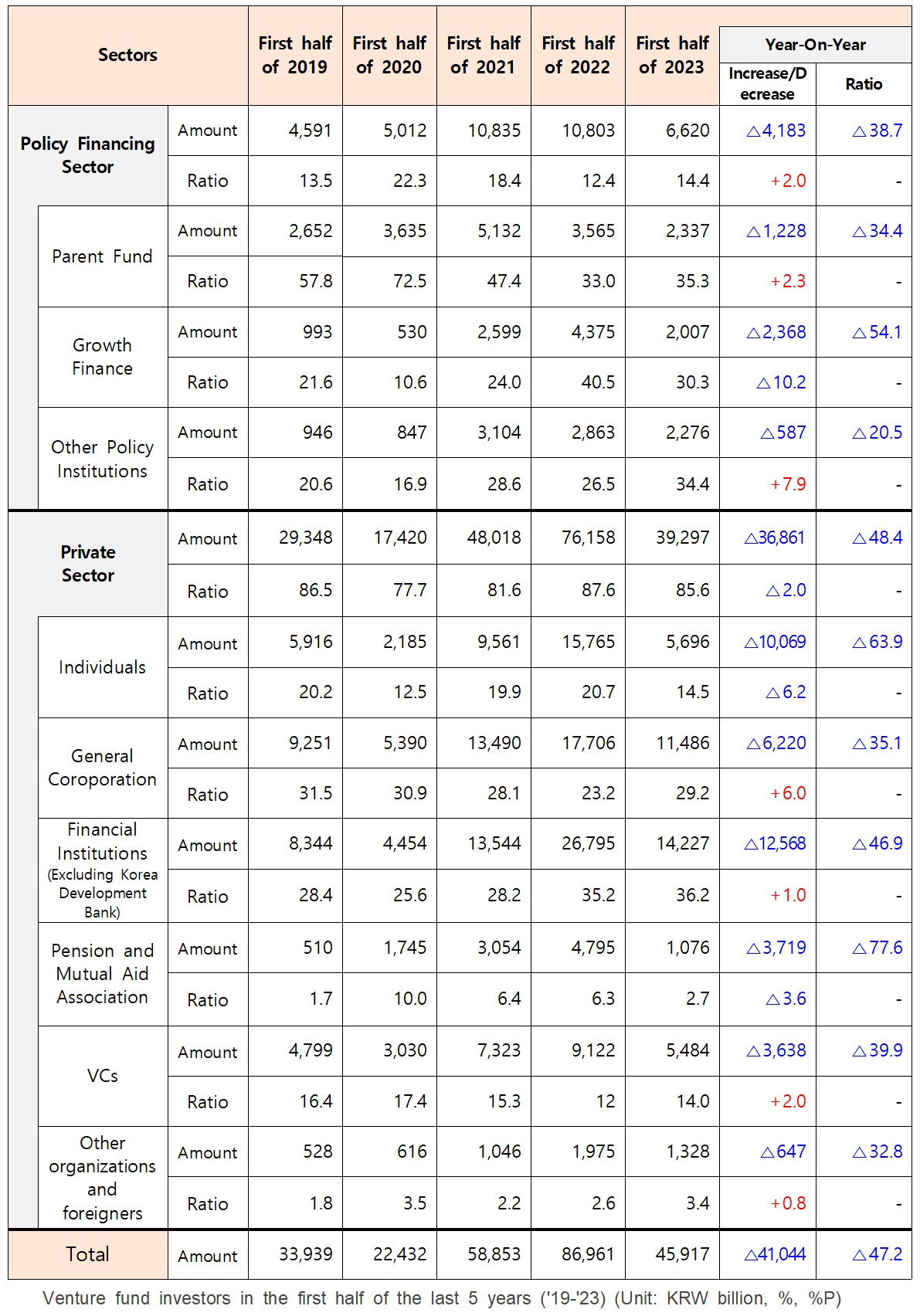

In the first half of 2023, fund closings amounted to KRW 4.6 trillion (approximately $3.5 billion), up 35% from the same period in 2019 and 105% from the same period in 2020. The number of venture investment funds is expected to increase further in the second half of the year, as the selection of the second round of parent funds was completed at the end of July and the formation of the first round of parent funds is expected to be completed by the end of October.

Both policy financing and private sector investment in venture funds declined year-on-year, but the decline in the private sector was relatively larger, likely due to the continued burden of high interest rates on investment.

댓글 남기기