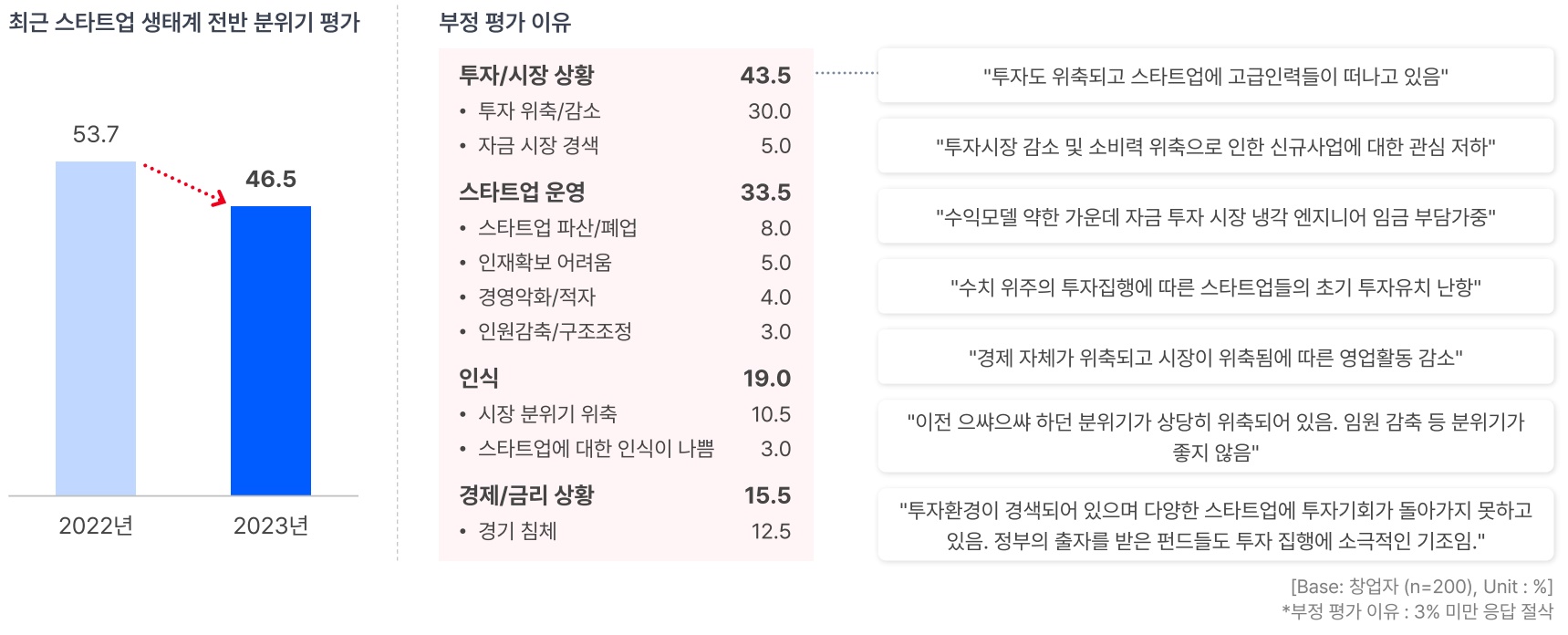

Founders gave the startup ecosystem a 46.51 rating this year, with feelings of recession and rising interest rates also high.

According to the Startup Trends Report 2023, conducted by Startup Alliance and OPENSURVEY, founders gave the startup ecosystem a rating of 46.5 this year. This is down 7.2 points from last year.

76.5% of founders felt that the startup ecosystem has “changed negatively” compared to last year (2022). They cited “lukewarm investment and support from venture capitalists (58.8%)” as the main reason for the negative change. Nine percent of entrepreneurs believe that the startup ecosystem has changed positively compared to one year ago, citing “spreading positive social awareness about startups (55.6%)” as the main reason.

As a result of the economic downturn and sensitivity to rising interest rates, 45.0% of founders expect “little change” in the startup ecosystem over the next year to 2024.

Founders were most likely to struggle with ‘estimating the value of the business’ (38.0%) when seeking funding. All founders, regardless of years in business and stage of fundraising, reported difficulties with valuation. Founders in their third year or less were more likely to select ‘Strict qualifications and screening process (15.8%)’ than those in their fourth year or more.

8 out of 10 founders felt that the startup investment market had shrunk this year compared to last year. In fact, 63.0% of founders say it’s actually harder to attract investment compared to last year.

To prepare for a tougher venture capital market, founders said they would focus on ‘diversifying their revenue streams’ (54.0%). This was followed by ‘focusing on profitable businesses’ (51.0%), ‘reducing business costs’ (46.5%) and ‘pursuing government-backed projects’ (43.0%). Notably, founders cited ‘reducing company costs’ as the most common response to the same question last year, but this year they seem to be focusing on developing business strategies to strengthen their companies.

Preferred investors and organisations are NAVER, Google Campus, Primer and Altos Ventures… Government rating is 52.5

When asked which company is most active in supporting startups, founders most often chose NAVER with 25.5% (based on 1st rank response criteria), followed by Kakao with 20.5% and Samsung with 10.5%. Compared to last year, the preferences of POSCO and GS have increased slightly, and NCSOFT is a new entrant.

Google Startup Campus (21.5%) received the highest number of responses for the incubator they would most like to move into/use. Seoul Venture Hub (9.5%) and Asan Nanum Foundation’s MARU180 (7.5%) rounded out the top three.

In terms of favourite accelerator, many accelerators were evenly split. The most popular accelerator was Primer (9.5%), as it was last year (based on 1st rank response criteria), followed by FuturePlay (8.5%) and SparkLabs (8.5%). The Ventures (5.5%), followed by Sopoong Ventures and MashUp Angels (5.0%).

When asked to name their favourite venture capital (VC) firm, Altos Ventures came out on top by a wide margin with 16.0%. This was followed by KB Investment (8.0%), SoftBank Ventures (7.5%), Mirae Asset Venture Investment (4.5%), Korea Investment Partners and BonAngles Venture Partners (4.0%) (based on 1st rank response criteria).

The most preferred CVC for founders is Kakao Ventures (15.5%), based on 1st rank response criteria. In second place was NAVER D2SF (10.0%).

The role of government was rated at 52.5 points, down 9.6 points from 62.1 points last year. Founders who had been in business for more than six years rated the role of government relatively low. The most helpful government policy was ‘TIPS and other business expenses’ (50.0%).

Founders said that the most urgent tasks for the government are to secure ecosystem-based funding and stimulate investment (29.5%), to ease regulations (25.0%) and to support M&A and stimulate IPOs (10.0%). The number of responses related to stimulating investment has decreased by 6%p since last year, while the call for deregulation has increased by 7%p since last year.

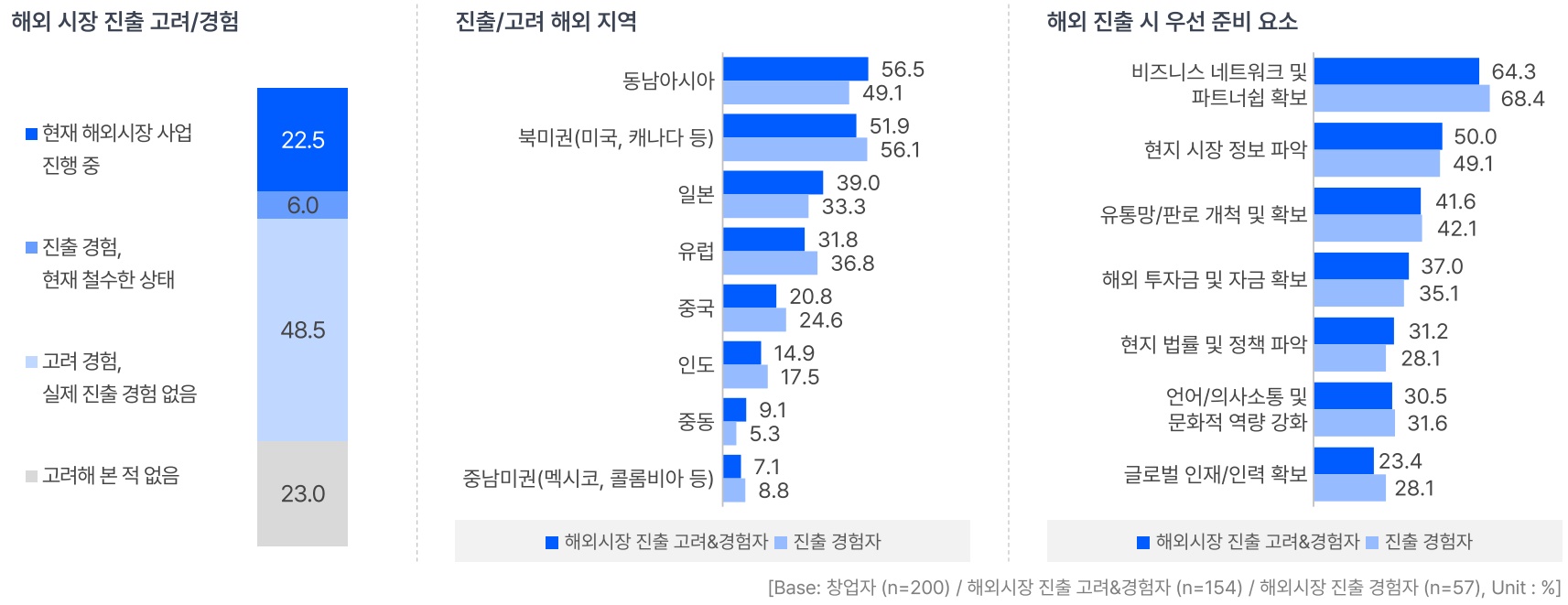

“Southeast Asia, North America and Japan” are the regions the founders want to expand into.

This year’s Trend Report asked about going global.

22.5% of founders currently operate internationally and 48.5% have considered going international. They said they had expanded or were considering expanding into the following regions South East Asia (56.5%), North America (51.9%), Japan (39.0%) and Europe (31.8%).

In particular, founders who have expanded or are considering expanding internationally say that ‘establishing a local entity/branch (28.9%)’ is their top priority. This was followed by ‘attracting local VC investment’ (17.6%), ‘government support to go global’ (16.2%) and ‘hiring global talent’ (12.0%) as the areas in which founders were specifically preparing to enter overseas markets.

They cited “securing business networks and partnerships (59.1%)” as a challenge when expanding overseas. This was followed by ‘developing and securing distribution networks/outlets (47.4%)’ and ‘securing overseas investment and finance (44.8%)’.

Of the 32.6% of entrepreneurs who are not considering expanding into international markets, they are doing so to ‘focus on the domestic market’. This was followed by ‘lack of local business networks’ (19.6%) and ‘focus on monetising the business’ (13.0%).

Employees and job seekers are less likely to consider starting a business… Software/Solutions is the most popular startup industry to move into.

Meanwhile, the proportion of startup employees, large company employees and job seekers considering starting their own business has fallen. In the past year, 47.2% of startup employees have considered starting their own business, down 10.8%p on the previous year. 52.8% of employees in large enterprises and 45.5% of job seekers have considered starting a business, down by 1.2%p and 5.5%p respectively compared to last year.

Among the startup employees who have considered starting their own business, 17.8% have considered e-commerce/distribution and 11.6% have considered software/solutions. The most common start-up industries for employees in large enterprises were ‘e-commerce/distribution’ (14.3%) and ‘agri-food’ (14.3%). Job seekers said they would consider ‘fashion/beauty’ (20.8%) and ‘content/media’ (18.8%) if they were to start a business.

Software/solutions, deep tech and fintech were the most popular startup sectors to move to. Among startup employees considering moving to the same startup, 44.3% said they would move to software/solutions. Employees of large companies considering a move to a startup preferred fintech (27.7%), deep tech (23.4%) and software/solutions (21.3%).

“Although the startup ecosystem has become very rigid due to the economic downturn and rising interest rates, startups themselves are overcoming this situation by focusing on revenue diversification and profitable businesses,” said Startup Alliance. “We hope that new opportunities will emerge as governments, investors and support organisations work together to find solutions in overseas markets.”

Meanwhile, the Startup Trends Report is a survey conducted jointly by Startup Alliance and OPENSURVEY since 2014, and is used as an indicator to identify trends in the startup industry, including founders and employees. This year’s survey was conducted through OPENSURVEY and REMEMBER (Founders) over a total of nine days from 5 to 13 September, with 200 founders, 250 employees of large companies, 250 employees of startups, and 200 job seekers to enter the workforce participating in the survey.

Leave a Comment