In what has been called the coldest year for startup investment, $3.8 billion (KRW 5 trillion) was invested in 2023.

According to Startup Alliance’s own research based on public media reports, the total number of startup investments in 2023 was 1,284, with a total investment of $4 billion (KRW 5.338 trillion). Compared to the investment performance in 2022, the number of investments decreased from 1765 to 1284 (-27.25%). The total amount invested decreased by almost half, from approximately $8.345 billion (KRW 11.1404 trillion) in 2022 to $4 billion (KRW 5.3388 trillion) (-52.08%).

Last year, the startup investment market froze, and large investments decreased significantly. On the other hand, early-stage investments were strong, with investments under $750 million (KRW 1 billion) accounting for 63% (817) of all investments.

Healthcare, Manufacturing and Content & Social were the top sectors in terms of number of investments. The cold, difficult investment period seems to have boosted investment in the healthcare and deep tech sectors, which have potential value in the medium to long term.

Finance & Insurance, Content & Social and Manufacturing were the top three sectors by number of investments. These were $549.1 million (KRW 733 billion) in Finance & Insurance, $483.7 million (KRW 645.8 billion) in Content & Social, and $469.5 million (KRW 626.8 billion) in Manufacturing.

In particular, the AI and semiconductor sectors attracted a lot of attention last year with OpenAI’s ChatGPT craze. In healthcare, AI precision medicine service ImpriMed and AI brain disease imaging solution Neurophet attracted $22.5 million (KRW 3 billion) and $15 million (KRW 2 billion) respectively. In manufacturing, MangoBoost, which develops DPU (data processing unit) semiconductors, received $52.5 million (KRW 7 billion) and SEMIFIVE, a custom semiconductor design solution, received $5.1 million (KRW 6.8 billion). On the content side, Twelve Labs, a video AI giant, became the first Korean startup to receive investment from NVIDIA.

In terms of startup exits, there were 53 mergers and acquisitions (M&A) and 9 initial public offerings (IPOs). Compared to 2022, the number of M&As decreased from 126 to 53 (-57.94%). Major M&A deals included entertainment company HYBE’s acquisition of AI audio startup Supertone, Kakao’s Japanese subsidiary Piccoma’s acquisition of content translation startup Voithru, and Riiid, the operator of Santa TOEIC,’s acquisition of Qualson, the operator of English learning content Real Class. Major IPOs last year included space technology startup CONTEC and semiconductor fabless startup FADU.

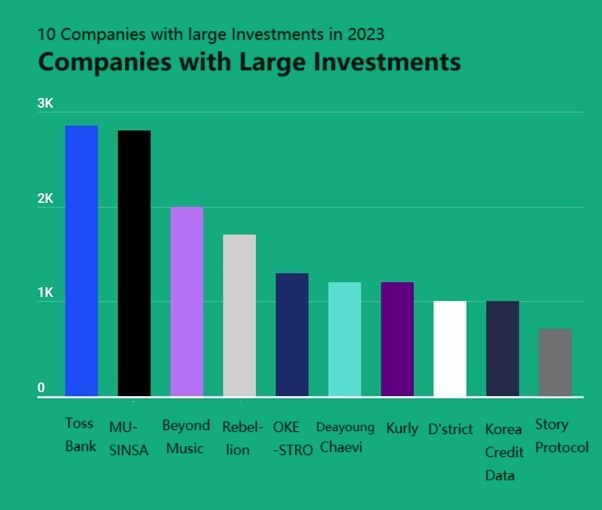

A total of 9 startups raised large investments, such as more than $75 million (KRW 10 billion) in funding. They include Toss Bank, MUSINSA, Beyond Music, Rebellions, OKESTRO, Kurly and D’strict.

Leave a Comment