Platum publishes a monthly report on startup investment trends in Korea. The target of our research is confined to domestic startups (including companies doing service overseas and domestic VCs’ overseas investment cases).

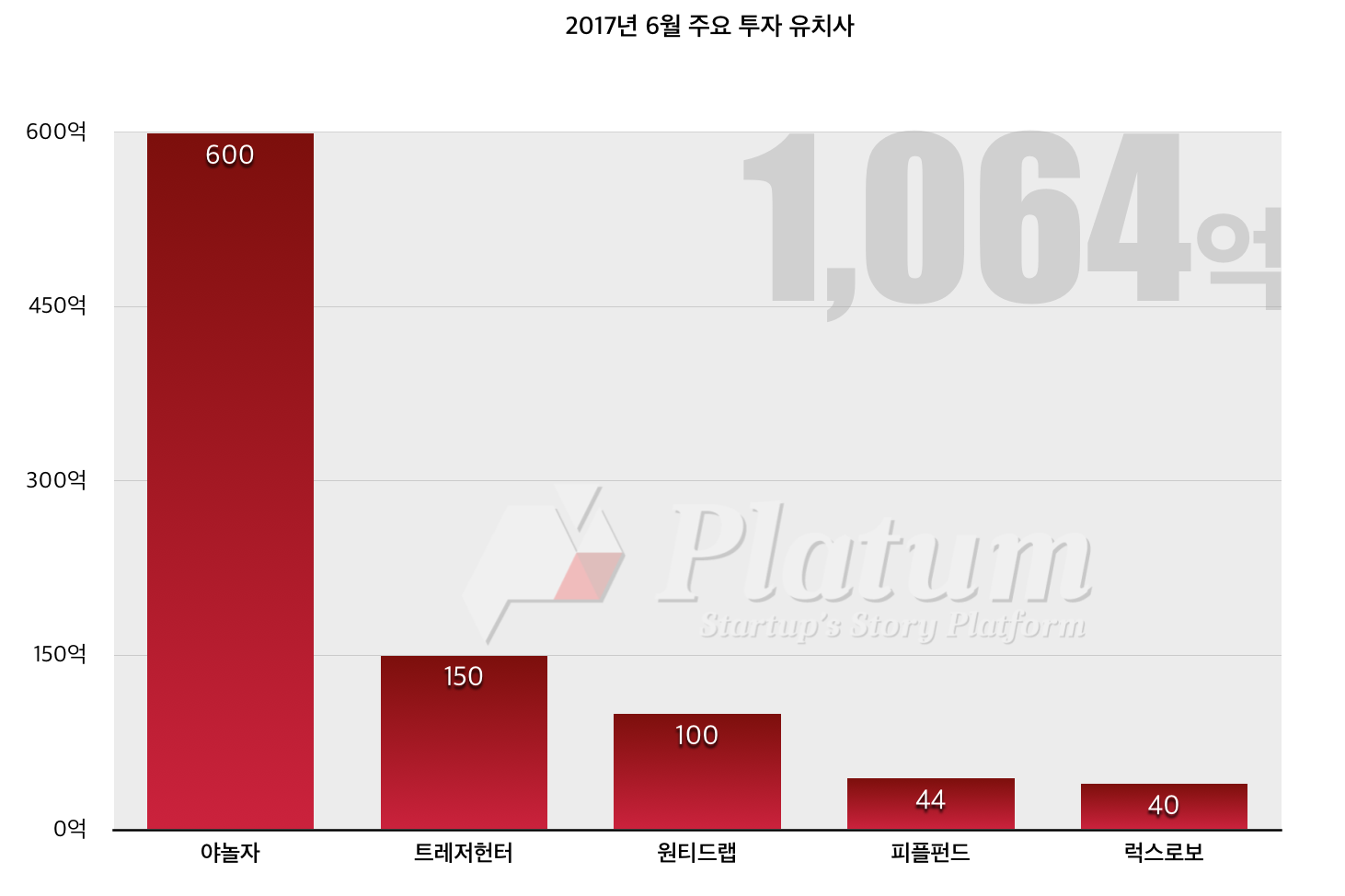

In June, 24 startup investments totaled USD 93 million (106.4 billion won), of which 2 were strategic investments and 9 were non-disclosures. Cumulative investment was 39.9 billion won in May, 20.95 billion won in April, 75.15 billion won in March, 38.8 billion won in February, and 23.7 billion won in January.

Yanolja, an O2O accommodation startup, attracted the biggest investment this month, receiving 60 billion won from SkyLake Investment alone. SkyLake acquired Yanolja’s redeemable convertible preferred stock (RCPS) on the condition that Yanolja goes public within five years. SkyLake Investment, a private equity fund (PEF) led by the former Minister of Information and Communication, Jin Dae-jae, invests mainly in IT companies with high growth potential.

With this influx of money, Yanolja plans to better their user experience by enhancing the reservation system not only in mobile App but also on PC web. They hope to strengthen the B2B service capabilities by upgrading operation and reservation systems, diversifying partners, and improving cost efficiency.

There were also large-scale investments in the Multi-channel Network (MCN) industry. Treasure Hunter, a leading startup in the MCN field, attracted 15 billion won investment from Malaysian investor, Linktu Infotainment. Treasure Hunter would be able to make strategic synergies with its investor especially when it comes to advancing in the Southeast Asia and China markets. Treasure Hunter will embark on ‘Connected Creative Content, Culture Creator’ strategy based on its content planning and network capabilities for those overseas markets.

Wanted Lab, a startup that manages referral recruitment service Wanted, has attracted a total of 10 billion won from 11 institutions in Korea and Japan. After its service started in 2015, Wanted Lab has secured more than 1,000 corporate clients including Facebook, Amazon Web Services, Nexon, and SKT. Also, it has entered the Japanese market, already serving local companies such as Rakuten and SBI since April of this year. Lee Bokkee, CEO of Wanted Lab said, “People trust acquaintances’ recommendation the most. So, there is an increasing proportion of recruitment through referrals. In the future, with social networks and artificial intelligence, recruitment process will be renovated. We plan to advance into global metropolitan cities one by one.”

Compared to the first half of the previous year, the number of investments, as well as, the total amount of investments decreased. A total of 116 investments (compared to 126 last year) amounted to 304.9 billion won. The total investment amount of 31% is lower than the first half of last year as well.

Looking from the industry perspective, Fintech is the most active investment area in the first half of this year. In March, Viva Republica, which operates a commission-free remittance service, attracted a total investment of 55 billion won. Also, in May, a total of 10 billion won was invested in Lendit, a P2P lending startup. Both deals involved Altos Ventures, a silicon-valley VC actively investing in Korean startups. In the same month, Korea NFC attracted a 3 billion won investment.

In addition, this year, investments in various high tech fields such as VR have also increased. Especially, compared to last year, a lot of funds have dedicated investments to artificial intelligence-related startups that are newly established.

Naver announced that it will expand its investment in the AI field by increasing the size of the SB Next Media Innovation Fund, jointly formed with Softbank Ventures in 2016 to 50 billion won. And, Woowa Brothers, a leading food-tech startup servicing ‘Baedal Minjok’, announced the launch of their own artificial intelligence project for the first time with an invest of 10 billion won in the artificial intelligence field. Kakao, the country’s top mobile messenger company with some 50 million monthly users, announced that it would speed up its own artificial intelligence platform business in March. They have started various startup support programs, made large-scale recruitments in related departments, and published AI reports. The company also directly invests in AI startups through its subsidiaries such as Kakao Brain and Kakao Investments.

Companies that attracted large-scale investments in the first half of this year include Trustus (9 billion won / January), Bagel code (14.3 billion won / February), Vivai Republica (55 billion won / March), Fast Five (12 billion won / April), Lendit (10 billion won /May), and Yanolja (60 billion won / June). Meanwhile, Korea’s tech giants, such as Kakao and Ticket Monsters are making massive investments.

List of companies that attracted investments in June

– Wanted Lab: Recruitment service / 10 billion won

– Stripes: Tailored male fashion / Strategic Investment

– Cupix: 3D Virtual Reality / Strategic Investment

– People Fund: P2P Finance / 4.4 billion

– LuxRobo: robot module platform / 4 billion

– TouchWorks: Membership service ‘Touching’ / 3 Billion

– Yanolja: Accommodation O2O / 60 billion

– Brich: Fashion O2O / 2.5 Billion

– Social Network: Augmented Reality / Private

– Treasure Hunter: MCN / 15 Billion

– Nerd Games: Mobile Games / 1.3 Billion

– Handys: Space management O2O / 300 million

– Hey Beauty: Beauty shop reservation service / Private

– Logi Brothers: Edutech / Private

– Riiid: artificial intelligence tutor technology / private

– Venditz (이사모아) : Assisting house moving / 600 million

– Stays: Residential space lease platform / 2.1 billion

– Lablup: Big data and machine learning processing solution / 2 billion

– Bomapp: Insurance platform / 1.2 billion

– Wing Bling: SNS-based accessory e-commerce / private

– Outerkorea: Advertising model Platform ‘Find Star’ / Private

– Dr. Diary: Mobile-based blood glucose management solution / private

– Soda Crew: International remittance / Private

– Habit Factory: consumption analysis service ‘signal’ / priv

This article, entitled “Startup investment trend in South Korea: Fintech and AI are investor favorites”, was written in Korean by Jung Sae-Rom of Platum, edited by AllTechAsia.

![[기고] 위험은 스타트업이, 열매는 공공이… 혁신의 주인공은 누구인가 3f3b00ac-efb7-456f-8bae-91cb3c75e27d](https://platum.kr/wp-content/uploads/2025/10/3f3b00ac-efb7-456f-8bae-91cb3c75e27d-1-150x150.jpg)

![[중국 비즈니스 트렌드&동향] 플랫폼 경계를 넘다: 지도·음료·물류의 영역 확장 45875595001_4c61b142b5_b](https://platum.kr/wp-content/uploads/2025/04/45875595001_4c61b142b5_b-150x150.jpg)

Leave a Comment