South Korean fintech startup, Balance Hero, announced on July 24 that it acquired a PPI (Prepaid Payment Instrument) license from the Bank of India. A PPI is a means of depositing a certain amount of money into a mobile wallet or prepaid card using cash, a card, or an account, and then making transactions offline and online. A PPI license is required to run a mobile payment business in India.

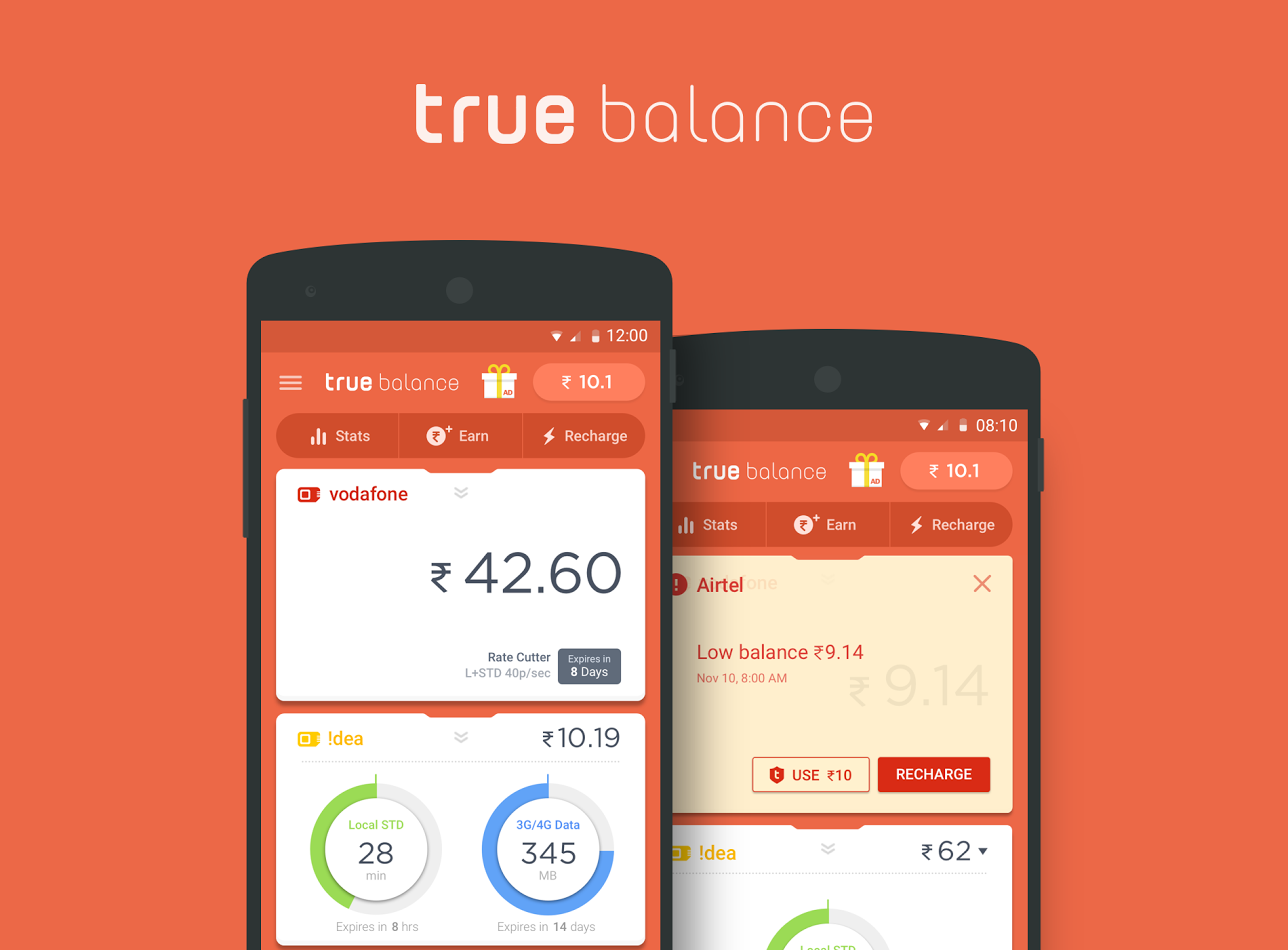

With this PPI license, Balance Hero will be able to expand its business by adding a variety of electronic payment functions to ‘True Balance’, a utility application made and run by Balance Hero. True Balance is a number one app that has now surpassed 40 million downloads and offers communications and data management as well as charging capabilities.

In recent years, more and more operators in India have requested issuance of PPI licenses to enter the market for mobile payments. There are global companies such as Amazon and Whatsapp that have been issued a PPI license along with Balance Hero. Major carriers such as Vodafone and Airtel, which are India’s major telecom operators, received licenses in 2016.

In countries like South Korea, the U.S., and Japan, there already exist prevalent payment methods such as credit cards and debit cards. However, like in China, the percentage of credit and debit card usage in India is very low. For that reason, India is ripe for the mobile payment industry and the government of India is actively giving out PPI licenses to companies in the hopes that these companies, both domestic and foreign, will replace cash and become the next wallet for people.

Bank of America Merrill Lynch predicted that the mobile payment market in India will grow to about 3,500 trillion Won (about $ 3 trillion), about 200 times the current level. The E-commerce industry is booming in India with a surge of smartphones usage. Non-cash payments, including mobile and card, are becoming more and more popular throughout India. Bank of America Merrill Lynch calculated that in the mid-2022s, mobile payment will grow faster than cash payment.

Balance Hero witnessed the huge growth potential of the Indian market in its early days and came to India to start local operations in 2014, but its service has not always been mobile payment. True Balance used to be a balance management utility application that helped prepaid users save and manage their mobile balances. An estimated 95% of mobile users use the prepaid method. True Balance has attracted 40 million users so far. Now, Balance Hero aspires to expand their business to mobile payment.

Cheol Won Lee, CEO of Balance Hero, said “True Balance is the number one app in the utility category. We plan to leverage our status and resources in India to push further our new mobile payment business.”

————————————————————————————-

This article, entitled “Balance Hero, 1st Korean startup to become an electronic payment provider in India”, was written in Korean by Stephanie Seo of Platum, edited by AllTechAsia.

댓글 남기기