Corporate venture capital(CVC) now accounts for 31% of all venture capital investment, according to a new study.

According to the report ‘CVCs in Korea: Current Status and Investment Promotion Plan’, published by Startup Alliance(스타트업얼라이언스), there are a total of 201 independent corporate CVCs operating in Korea. Of these, there are 176 CVCs operating in Korea, excluding CVCs from overseas companies.

The researchers defined CVC as “financial capital for startup investment from non-financial general corporations”. Depending on who manages the capital, they classified them as ‘independent corporate CVCs’ (where companies set up subsidiaries specialising in investment, such as GS Ventures and LOTTE Ventures), ‘in-house CVCs’ (where companies set up investment departments or assign dedicated staff to manage the capital, such as NAVER D2SF and Hyundai Motor Group ZER01NE, and ‘funded CVCs’ (where companies invest in external venture capital funds).

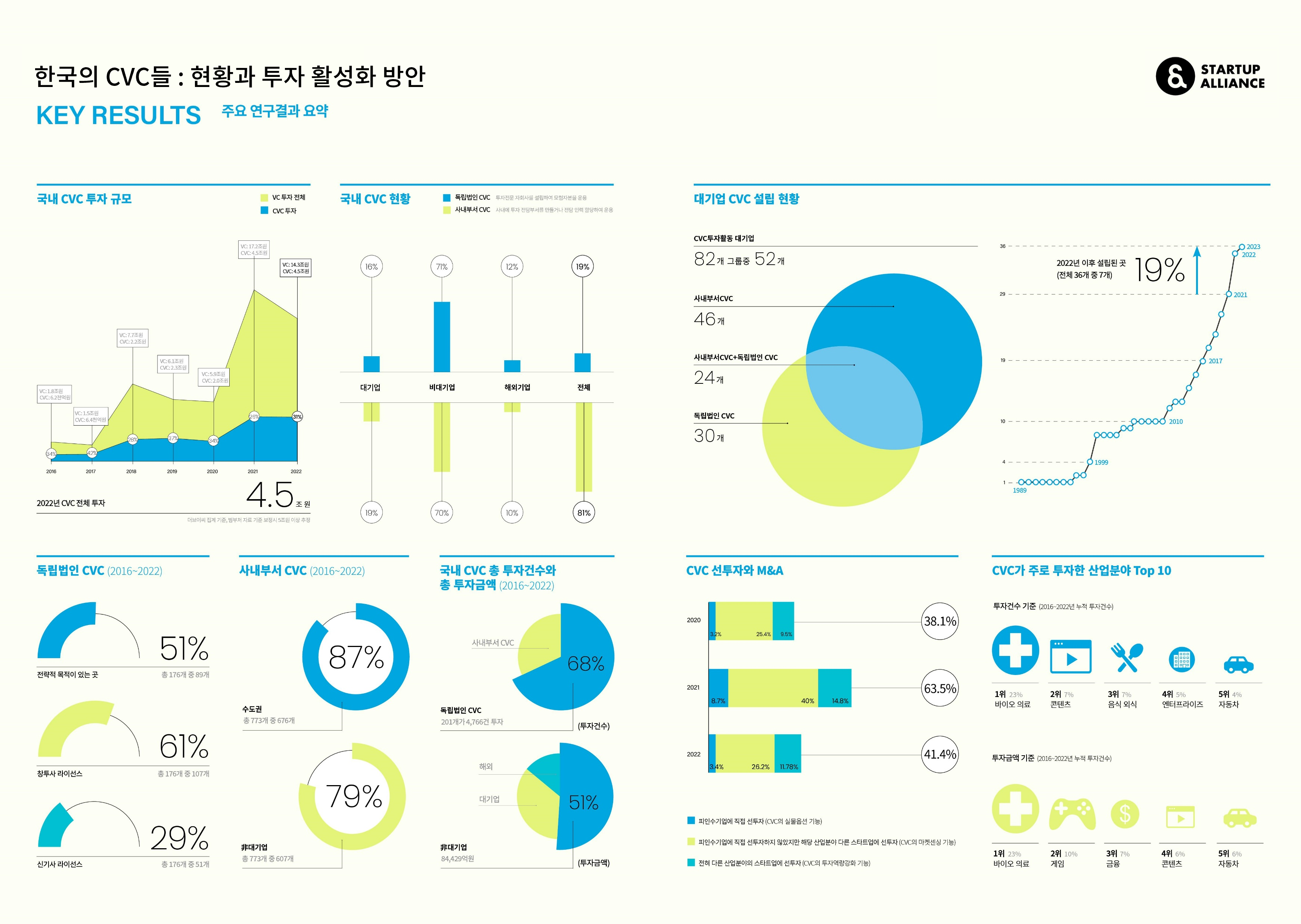

According to the report, despite a 17% decline in total venture capital investment from $12.7 billion (KRW 17.2 trillion) in 2021 to $10.6 billion (KRW 14.3 trillion) in 2022 due to last year’s economic downturn, CVC investment will remain similar to the previous year at $3.3 billion (KRW 4.5 trillion) in 2021 and 2022. This represents 31% of total venture capital investment. The researchers say that by comparing the limitations of the investment data with the government’s venture investment data, it is possible to estimate CVC investment at more than $3.7 billion (KRW 5 trillion) in 2022.

Comparing CVCs by management entity, the investment volume of in-house CVCs is growing faster than that of independent CVCs. In 2022, the investment volume of independent CVCs accounted for 13% of total venture capital investment, while the investment volume of in-house CVCs accounted for 19% of total venture capital investment, and the investment volume of in-house CVCs has overtaken the investment volume of independent CVCs since 2021.

In 2023, 52 group companies (63%) out of 82 subject to disclosure had a confirmed history of CVC investment activity. Of these, 30 group companies (37% of the total) have a history of CVC activity as independent entities and 46 group companies (56% of the total) have a history of CVC activity as internal departments. 24 group companies (29% of the total) have a history of both.

In particular, the number of CVCs established by conglomerates has increased since the amendment to the Fair Trade Act (implemented in December 2021), which allowed general holding companies to hold CVCs on a limited basis. Of the 36 CVCs established by large conglomerates, 7 have been established since 2022, accounting for 19% of the total.

Based on 323 M&A transactions between 2020 and 2022, the report also analysed whether CVC investment preceded the M&A. It found that 157 M&As, almost half (48.6%), were directly or indirectly preceded by CVC investment.

The researchers found that CVC investment that preceded M&As served three functions. First, in 17 (5.3%) of the 323 M&As, the acquirer made a CVC investment in the target company, either as a stand-alone entity or as an internal division, prior to the M&A. This suggests that the CVC investment acted as a real option function on the target in anticipation of the M&A transaction.

In the next 100 M&As (31.0% of the 323 total), the acquirer made a CVC investment in another start-up in the same industry as the target prior to the M&A. This can be seen as a market sensing function to detect discontinuous technological change and find suitable targets.

Finally, in 40 cases (12.4% of the 323 cases), the acquirer made a CVC investment in a start-up in a completely different industry than the target prior to the M&A. This can be analysed as the acquiring company discovering and assessing the value of start-ups and strengthening its investment capabilities through CVC investment activities.

The report also suggests expanding CVC investment by medium-sized enterprises as a policy support measure to revitalise domestic CVC investment.

The current Fair Trade Act prohibits a conglomerate holding company from holding shares in a CVC that is a financial company, or a subsidiary of a holding company from controlling a CVC as an affiliate, based on the Financial-Industrial Separation Law. Article 20 of the Fair Trade Act allows general holding companies to hold CVCs on a limited basis. The research found that of the 158 general holding companies subject to the law in 2022, only 47 are large companies. The remaining 111 are medium-sized companies, suggesting that regulations designed to limit large companies are actually restricting investment by medium-sized CVCs. The researchers stressed the need for separate regulation of large and medium-sized companies to encourage the creation of medium-sized CVCs.

The study also found that 33% of CVCs from large companies were financial investors, while more than half of CVCs from non-large companies were classified as financial investors. These findings suggest that medium-sized companies, which should be focused on achieving strategic outcomes through collaboration with start-ups, are less likely to invest in CVCs for strategic purposes. Therefore, the report concludes that policy support for strategic investments by medium-sized enterprises is needed to stimulate CVC investment.

In addition to the current status of CVCs in Korea, the report also discusses the impact and role of CVC investment on the M&A market and provides policy suggestions to expand CVC investment. The study was conducted by Shinhyung Kang, Professor at the School of Management, Chungnam National University. The Venture Financing Research Institute of Korea Venture Investment Corp. also contributed to the study.

![[스타트업 탐방] 오후 5시, 자리는 비었지만 일은 계속되는 회사… 하이퍼커넥트 DSCF6818](https://platum.kr/wp-content/uploads/2025/11/DSCF6818-150x150.jpg)

![[BLT칼럼] 엔젤투자의 3가지 즐거움 1114b3aee2b12](https://platum.kr/wp-content/uploads/2025/11/1114b3aee2b12-150x150.png)

![[중국 비즈니스 트렌드&동향] 스타벅스 중국 사업 지분 60% 매각 20230510_133701](https://platum.kr/wp-content/uploads/2025/11/20230510_133701-150x150.jpg)

댓글 남기기